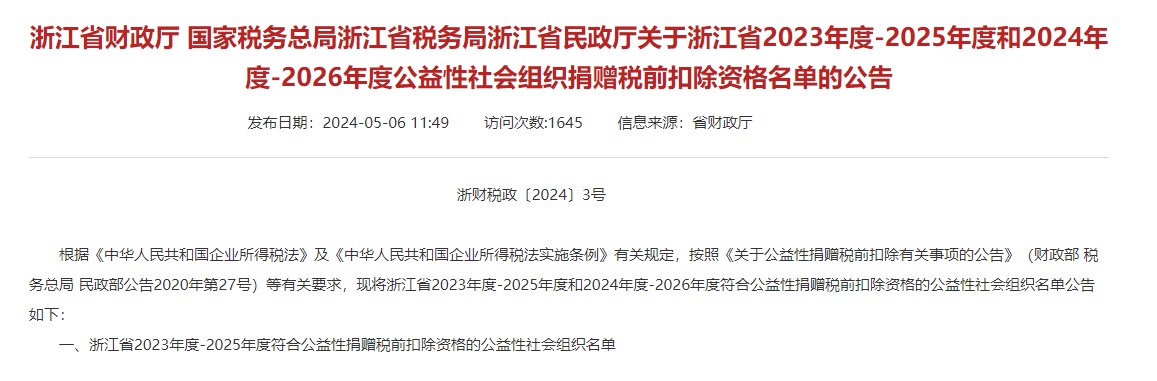

On May 6, 2024, the Zhejiang Provincial Department of Finance, the Zhejiang Tax Service of the State Taxation Administration, and the Department of Civil Affairs of Zhejiang Province jointly issued the "Announcement on the List of Eligible Public Welfare Organizations for Pre-Tax Deductions of Donations in Zhejiang Province for the Periods 2023-2025 and 2024-2026". PROYA Foundation was, for the first time, granted the qualification for pre-tax deductions for charitable donations in Zhejiang for the period of 2023 to 2025.

The pre-tax deduction qualification for charitable donations is a significant policy incentive that the state encourages for corporate and individual donations. Expenditures for the donations made to public welfare and charitable causes in compliance with legal provisions by enterprises or individuals, through non-profit social organizations, people's governments and their departments above the county level, and other state organs, are allowed to be deducted in accordance with tax laws in the calculation of their taxable income.

In simple terms, when donations are made to social organizations, public welfare mass organizations, and relevant government departments that are qualified for pre-tax deduction for public welfare donations, it is possible to reduce corporate income tax and personal income tax. This is the state's concession of tax revenue to encourage the development of charitable causes in society.

For the first time, the PROYA Foundation has been awarded the "Qualification for Pre-tax Deductions for Charitable Donations in Zhejiang for the Period of 2023-2025", marking a step towards the regularization and standardization of the foundation. Moving forward, we will continue to adhere to the principles of charity, regulate donation activities, and ensure that every donation is utilized for the development of public welfare projects, contributing greater strength to the national public welfare undertakings!